AI chip giant Nvidia shares fall despite record sales

3 min read

Shares in Nvidia have declined even though the company reported impressive financial results, surpassing expectations with its record sales figures. Nvidia, a leader in artificial intelligence (AI) chips, announced that its revenue for the three-month period reached a staggering $30 billion (£24.7 billion).

The company has greatly benefited from the AI boom, which has driven its stock market value to exceed $3 trillion. However, despite this impressive performance, Nvidia’s share price dropped by 6% in after-hours trading in New York.

Analysts had anticipated sales of around $28.7 billion for the period ending July 28, but Nvidia significantly exceeded these projections with a 122% increase in revenue compared to the same quarter last year. Despite this substantial growth, the market response was less enthusiastic than expected.

Simon French, head of research at Panmure Gordon, noted that while Nvidia has consistently delivered impressive sales figures, the latest results suggest that the company’s rate of growth might be slowing. “The rate of growth is starting to decelerate,” French remarked. This trend has led to some concern among investors and analysts, who are accustomed to Nvidia’s consistently high growth rates.

Matt Britzman, a senior equity analyst at Hargreaves Lansdown, commented that the market’s reaction reflects a shift in expectations. “It’s less about just beating estimates now. Markets expect them to significantly exceed forecasts, and the scale of the beat today seems to have slightly disappointed.”

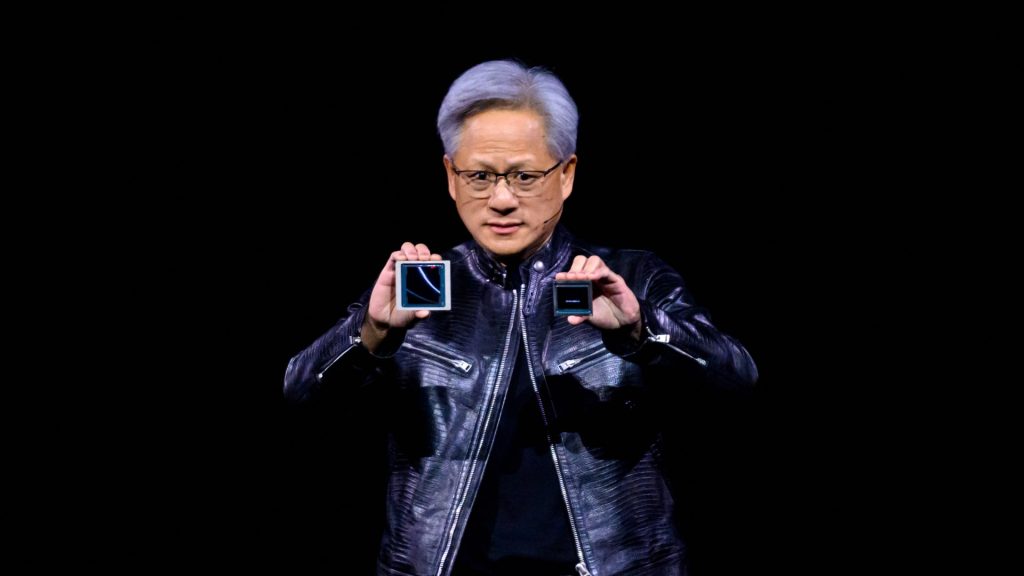

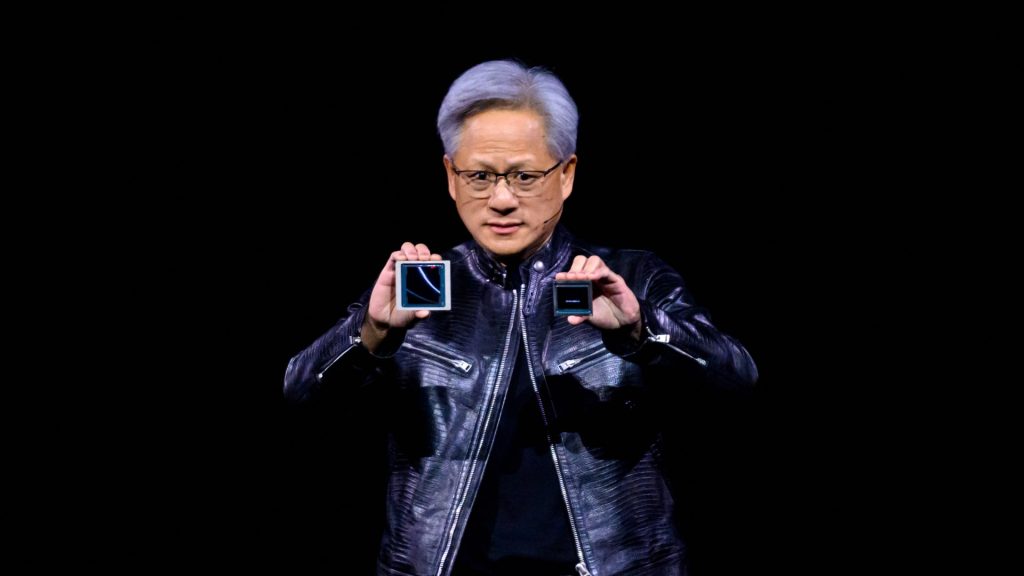

Nvidia’s CEO, Jensen Huang, emphasized the transformative potential of AI in his announcement, stating, “Generative AI will revolutionize every industry.” However, French pointed out that high expectations come with high demands. “If you’re going to raise expectations to such levels, you need to sustain spectacular growth rates,” he said.

Additionally, Nvidia is facing some challenges with its product lineup. While the current AI chip, Hopper, is performing well, there have been production delays with the next-generation Blackwell chip. French suggested that these delays might be contributing to the post-earnings decline in Nvidia’s stock.

The quarterly earnings announcements from Nvidia have become major events on Wall Street, often triggering a flurry of trading activity. According to the Wall Street Journal, a “watch party” was planned in Manhattan for the results release. Huang, known for his distinctive leather jacket, has earned a reputation akin to a tech celebrity, often compared to the “Taylor Swift of tech.”

Alvin Nguyen, a senior analyst at Forrester, highlighted Nvidia’s pivotal role in the AI industry. “Nvidia and Jensen Huang have become the face of AI,” Nguyen noted. While this prominence has been advantageous, Nguyen also warned that if AI technology does not meet high expectations, it could negatively impact Nvidia’s valuation. “A thousand use cases for AI is not enough. You need a million,” he stated.

Nguyen also mentioned that Nvidia’s early entry into the AI market has given it a leading edge with superior products and a robust software ecosystem. However, he cautioned that competitors like Intel could potentially erode Nvidia’s market share if they develop more advanced products, although he acknowledged that this would be a gradual process.

Overall, Nvidia’s impressive sales figures highlight its strong position in the AI market, but the company faces ongoing challenges in maintaining its growth trajectory and managing investor expectations.