As the United States approaches a closely contested presidential election, betting on election outcomes has surged, transforming a once niche market into a multi-million dollar enterprise. Thomas Gruca, director of the Iowa Electronic Markets—one of the longest-running election betting platforms—reflects on the seismic shifts in this arena. What was once a “connoisseurs’ market,” with bets limited to $500 and minimal earnings, has evolved dramatically, especially in recent weeks.

This change can be largely attributed to a recent federal court ruling that favored election betting, dismissing arguments from U.S. market regulators that such activities violated state gambling laws. Since this ruling, platforms like Kalshi have reported over $100 million in wagers. The influx of funds has drawn attention from political campaigns and media alike, with many betting sites currently predicting a Republican victory for Donald Trump.

Trump himself has acknowledged the rising interest in election betting during his rallies, leveraging it to bolster his campaign narrative. High-profile supporters, including tech mogul Elon Musk, have emphasized the perceived accuracy of these betting markets, claiming they provide insights more reliable than traditional polls due to the financial stakes involved.

In contrast to the booming platforms that have emerged, Gruca’s Iowa Electronic Markets operates under strict regulations. While it accepts wagers for research purposes, the amount of money involved is minimal, with overall trading rarely exceeding $30,000. Unlike larger platforms that heavily favor Trump—some showing his odds at 60% or higher—Gruca’s market currently reflects a tilt toward Kamala Harris, illustrating a notable divergence in predictions.

Gruca is proud of his platform’s track record, which has consistently predicted the popular vote with remarkable accuracy. However, he expresses concern over the extreme figures emerging from larger betting platforms. He notes that while betting markets can provide valuable forecasting insights, they are not infallible. Past elections have shown that betting odds can misjudge outcomes, as evidenced by the 2016 election when Trump’s chances were significantly undervalued.

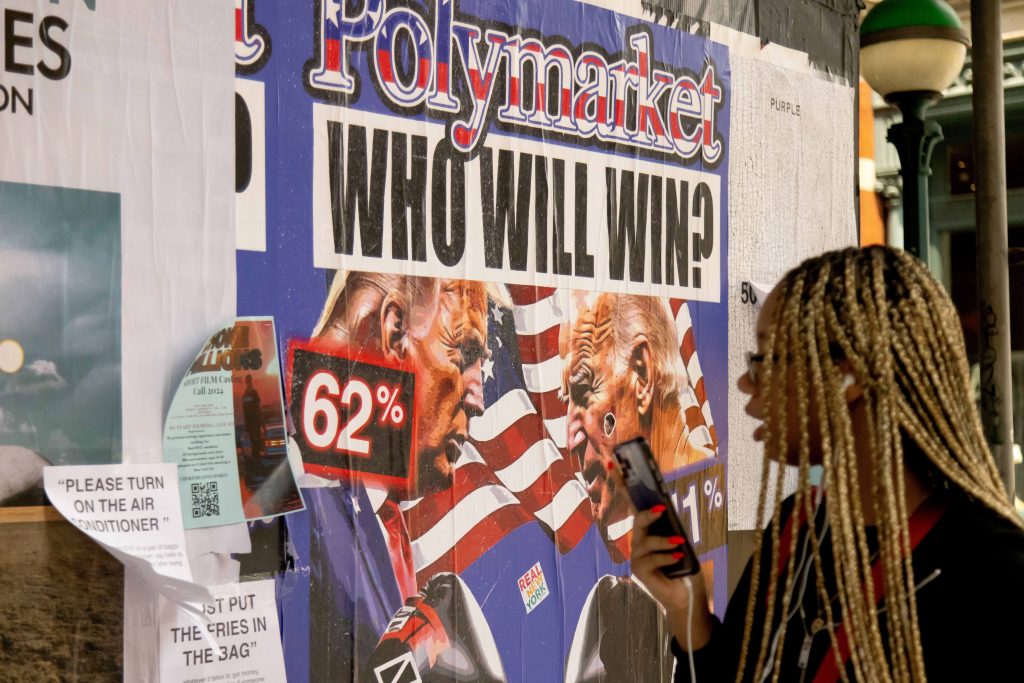

Academics caution that the lack of oversight on some of these platforms raises the potential for manipulation. In markets where there are no limits on bets, individuals with substantial resources can skew the odds, making it essential for participants to be skeptical of the information presented. For example, significant bets from a small number of accounts on platforms like Polymarket have impacted the odds in favor of Trump, raising concerns about the integrity of the market.

Polymarket operates differently from traditional platforms, allowing users to bet against each other on future events, using cryptocurrency for transactions. Critics, however, have flagged potential issues such as wash trading, where the same individuals engage in buying and selling to create a false impression of market activity. Despite its claims of accuracy, the platform has faced scrutiny regarding its operations and the potential consequences of its betting model on the electoral process.

In light of these developments, advocacy groups such as Better Markets have voiced concerns that unrestricted election betting could undermine the integrity of democracy. They warn that such markets could lead to manipulation and exploitation of investors, prompting calls for stricter regulation.

As Gruca notes, while election betting might seem like a distraction from serious threats to democracy, it remains a contentious topic. Each state in the U.S. has its own regulations governing betting, with some outright banning bets on elections. Furthermore, prediction markets, which allow trading on political outcomes, have historically faced resistance from federal regulators, who have viewed such activities as potentially harmful to the democratic process.

With the legal landscape shifting—especially following a 2018 Supreme Court ruling that facilitated sports betting—there is a growing discussion about the future of election betting. The Commodity Futures Trading Commission (CFTC) has proposed a rule that would bar trading on political events, arguing that such actions commodify the democratic process and could lead to broader issues of market integrity.

As the election approaches, the debate over the appropriateness of betting on political outcomes continues. For now, participants in this evolving market must navigate a landscape marked by uncertainty and regulatory scrutiny, as the electoral stakes rise alongside the betting frenzy.