IMF approves $7bn loan to cash-strapped Pakistan

3 min read

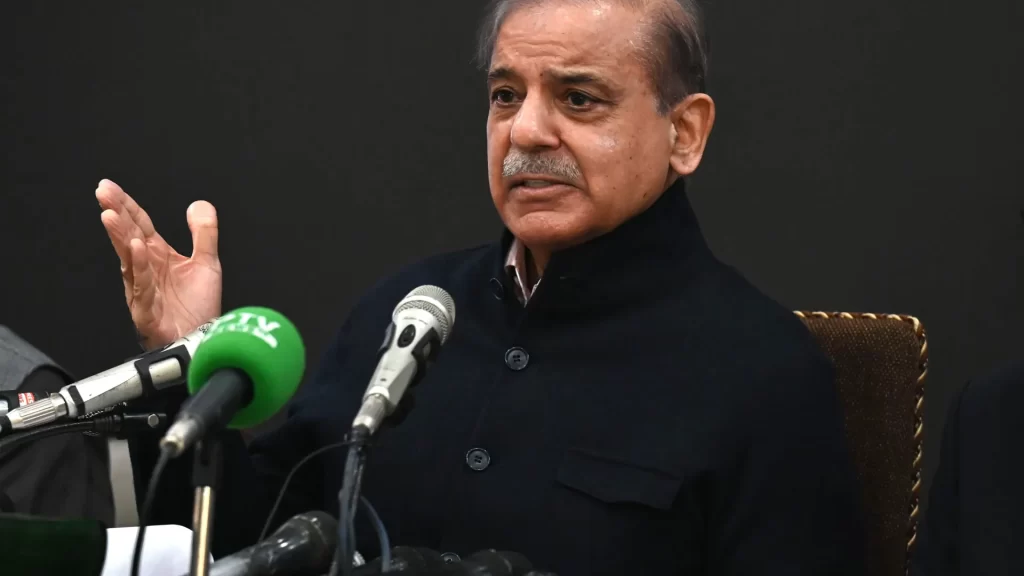

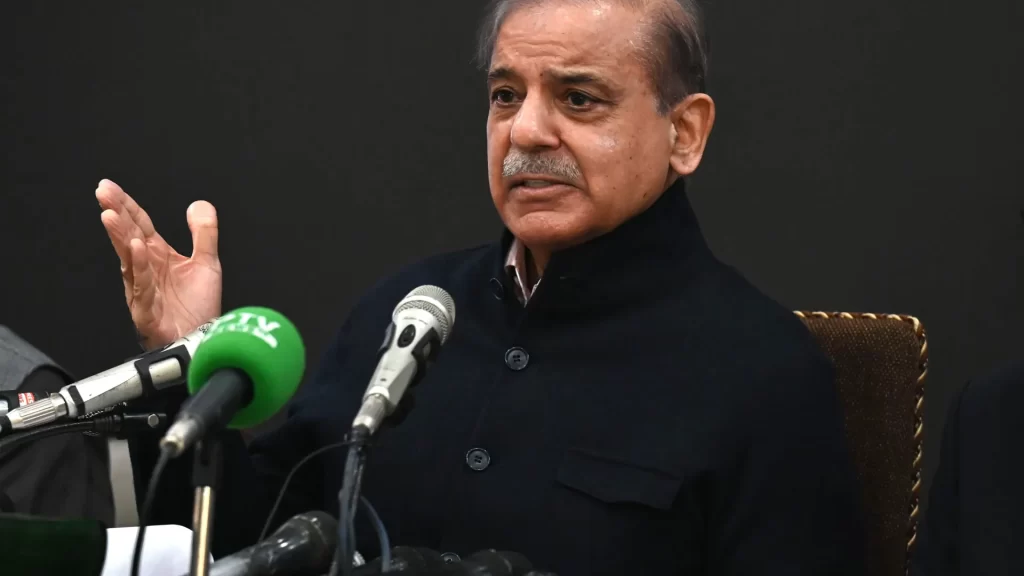

Prime Minister Shehbaz Sharif told Pakistani media that the country had fulfilled all of the lender's conditions.

Prime Minister Shehbaz Sharif told Pakistani media that the country had fulfilled all of the lender's conditions.

The International Monetary Fund (IMF) has approved a substantial loan of $7 billion (£5.25 billion) to assist Pakistan, which is facing a severe economic crisis. The initial disbursement of $1 billion will be made available immediately, with the remaining funds scheduled to be released over the next three years.

Prime Minister Shehbaz Sharif expressed gratitude for this decision, thanking IMF Managing Director Kristalina Georgieva and her team for their support. This new loan program marks a critical juncture for Pakistan, which has sought IMF assistance more than 20 times since 1958, making it the fifth-largest debtor of the institution.

The IMF has emphasized that the new program will necessitate “sound policies and reforms” to stabilize Pakistan’s economy and enhance its resilience. In a commitment to ensuring this loan will be the last from the IMF, Pakistan has pledged to undertake significant reforms, although many of these measures are likely to be unpopular with the public.

As part of the agreement, Islamabad has committed to increasing tax revenues from both individuals and businesses. This requirement reflects the broader trend of Pakistan relying on international loans to meet its financial needs, a situation compounded by years of financial mismanagement.

Last year, Pakistan faced the looming threat of defaulting on its debts, with foreign currency reserves dwindling to the point where the country could barely afford a month’s worth of imports. The urgency of this loan is underscored by the nation’s ongoing economic struggles.

In July 2023, the IMF approved a separate $3 billion bailout for Pakistan, which was crucial for the country during a time of heightened financial strain. In addition to the IMF’s support, Pakistan also secured funding from key allies, including Saudi Arabia and the United Arab Emirates (UAE). These loans were viewed as pivotal in helping stabilize the economy.

Prime Minister Sharif remarked that the earlier bailout was a significant step toward stabilizing the economic landscape. He stated, “It bolsters Pakistan’s economic position to overcome immediate to medium-term economic challenges,” underscoring the importance of international support in navigating the financial crisis.

The current economic environment in Pakistan is characterized by high inflation, soaring energy prices, and a depreciating currency, which have all contributed to widespread public discontent. The government’s ability to implement necessary reforms without exacerbating social unrest remains a critical challenge.

The decision to raise taxes is particularly contentious, as it may further strain the financial circumstances of everyday citizens already grappling with rising costs of living. The government’s challenge will be to communicate the necessity of these reforms effectively while managing public sentiment.

Moreover, the structural issues that have plagued Pakistan’s economy for decades, including poor governance and inadequate infrastructure, continue to impede growth. As the country embarks on this new program with the IMF, there will be an increased focus on implementing reforms aimed at fostering economic sustainability and preventing future crises.

While the $7 billion loan presents an opportunity for recovery, it is clear that the path ahead is fraught with difficulties. Pakistan’s leadership will need to demonstrate both resolve and transparency to rebuild trust among its citizens and the international community.

In summary, the IMF’s approval of a $7 billion loan is a crucial lifeline for Pakistan as it seeks to navigate a complex economic landscape. With immediate funds coming in and a commitment to significant reforms, the government faces the challenge of transforming its economy while addressing the pressing needs of its population. The success of this program will largely depend on the government’s ability to implement sound economic policies and foster a culture of accountability, which will be essential for building a more resilient future.