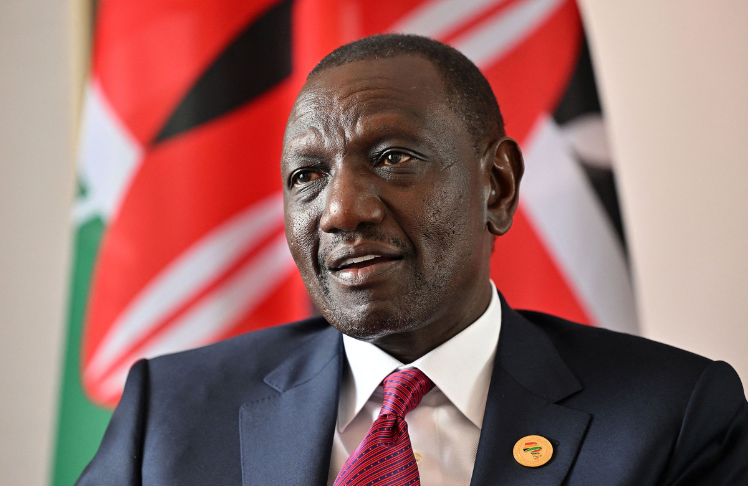

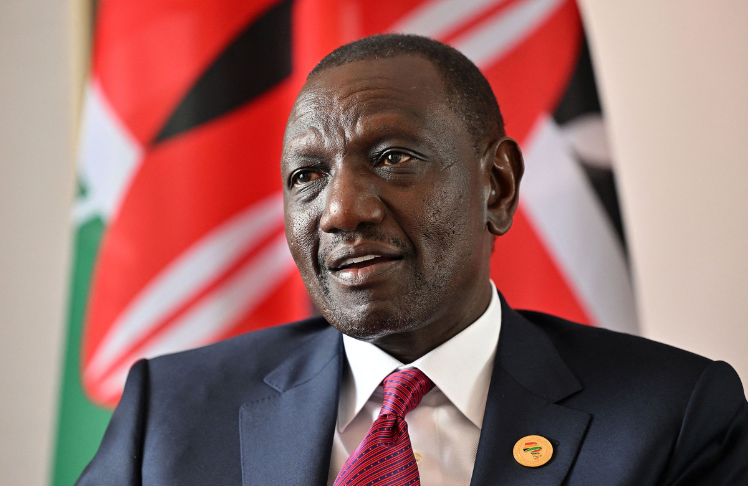

Kenyan President’s Tax Plans Hit Hard by Legal and Public Backlash

3 min read

Aug-8- Kenya’s President William Ruto is facing severe setbacks in his efforts to boost government revenue through new tax measures. Recent developments have compounded the challenges for his administration, which is already struggling with a hefty national debt and a strained budget.

Ruto’s tax plans suffered a major blow when widespread protests erupted over proposed tax increases, leading to a fire at the parliament building. In response to the public outcry, Ruto withdrew his proposed finance bill for the coming fiscal year. This was followed by another significant setback last week when Kenya’s appeals court invalidated the 2023 tax legislation. The court’s ruling deemed the legislation, which included increased taxes on salaries, fuel, and mobile money transactions, to be “fundamentally flawed” and “unconstitutional” due to procedural errors.

These legal and public challenges undermine the government’s efforts to raise additional revenue needed to cover a national budget and manage a public debt of approximately $78 billion. According to Mr. Nyoro, the collapse of the two recent finance acts represents a potential loss of over half a trillion shillings ($3.8 billion) in revenue.

The finance bill, introduced annually before the start of Kenya’s financial year in July, outlines new taxes or modifications to existing ones to generate revenue. Concurrently, an appropriations bill details how the funds will be allocated across government departments. The current fiscal confusion was highlighted when this year’s appropriations bill was enacted despite the withdrawal of the corresponding finance bill.

With both tax plans from 2023 and 2024 effectively invalidated, analysts suggest the government may need to revert to the 2022 tax legislation. Economist Odhiambo Ramogi points out that the court’s decision creates uncertainty for taxpayers, though it has ruled that taxes already collected cannot be refunded.

The government has appealed to the Supreme Court, seeking a suspension of the lower court’s decision until the appeal is heard. The Supreme Court, though on recess, has agreed to prioritize the case. Immediate pressure is likely to come from the public, who are demanding reductions in prices, particularly at the petrol pumps.

Ramogi suggests that redrafting a new finance bill could be the best course of action, although this faces opposition from a public wary of new taxes. Alternatively, the government may need to resort to borrowing more funds, but this option is complicated by the country’s already high debt levels and recent downgrades by credit rating agencies Moody’s and Fitch.

Experts propose that innovative and less burdensome tax strategies might be necessary, though specific solutions remain unclear. A consensus among policy analysts is that future tax legislation must better reflect public opinion and involve citizen engagement in governance processes.

In response to the financial shortfall, Ruto signed a supplementary appropriations bill, which cuts government expenditure by about $1.2 billion. This bill reduces funding for various sectors, including the presidency, ministries, and infrastructure projects. The parliamentary budget committee views this as a balanced approach between austerity and protecting citizens’ livelihoods.

In response to the financial shortfall, Ruto signed a supplementary appropriations bill, which cuts government expenditure by about $1.2 billion. This bill reduces funding for various sectors, including the presidency, ministries, and infrastructure projects. The parliamentary budget committee views this as a balanced approach between austerity and protecting citizens’ livelihoods.

However, the government is facing additional legal challenges from rights groups who argue that spending without matching revenue generation violates constitutional provisions. These groups have requested judicial intervention to address what they see as ongoing constitutional violations in the budgetary process.

As President Ruto navigates these legal and economic hurdles, Mr. Nyoro warns that there are no guarantees of success in the court battles. The government’s choices are increasingly difficult, and even strong protective measures may not suffice to shield Ruto from the mounting challenges.