State pension to rise by over £400 next year

2 min read

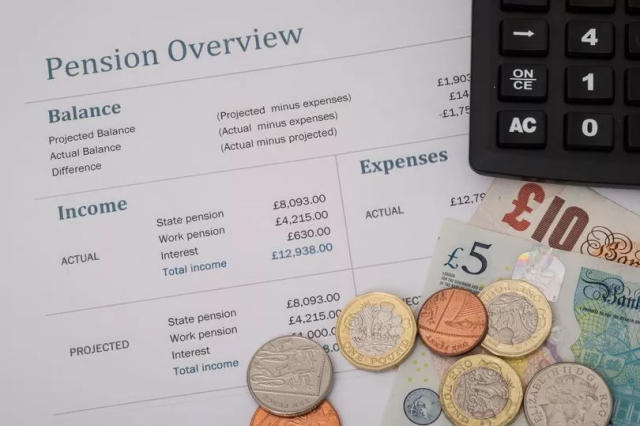

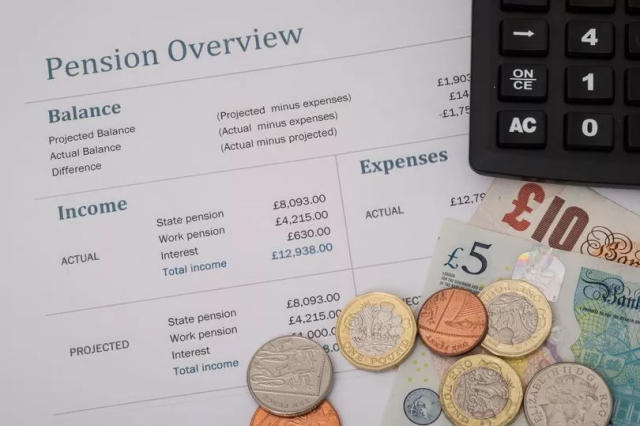

The Treasury anticipates a substantial rise in the state pension for the upcoming year, with projections indicating an increase of over £400 in cash terms, surpassing the rate of inflation. This anticipated boost is largely due to the triple lock mechanism, which mandates that the state pension grows each April by the highest of three measures: inflation, average earnings growth, or 2.5%.

Also, state pension will be adjusted based on the average earnings figures set to be released next week. This adjustment aligns with the triple lock policy, which aims to protect the value of the pension from being eroded by rising living costs or slow wage growth.

This positive news for pensioners comes amidst growing criticism of the government’s decision to reduce the winter fuel payment for the majority of pensioners. The reduction means that millions will see a decrease in their overall income, with the adjustment amounting to between £100 and £200 for many.

As a result of the upcoming increase, the full state pension for individuals born after 1951 (men) and after 1953 (women) is expected to approach £12,000 next year. This follows a previous £900 increase in the past year. For retirees who were eligible for a secondary state pension before 2016, their basic state pension under the old system is projected to rise by at least £300 annually, reaching approximately £9,000.

The final decision on the pension increase will be made by Pensions Secretary Liz Kendall ahead of next month’s Budget. However, Chancellor Rachel Reeves has reaffirmed the government’s support for maintaining the triple lock until the end of this parliamentary term. This commitment represents a significant financial pledge within the £130 billion annual state pension budget, a promise shared by all major political parties.

The triple lock, introduced by the Conservative-Liberal Democrat coalition in 2010, was designed to ensure that the value of the state pension remains robust against inflation and wage fluctuations. The mechanism compares three measures each year:

Despite the forthcoming increase, there is significant concern over the reduction of winter fuel payments. Critics, including campaigners and opposition parties, argue that the cut will adversely affect many pensioner households, particularly in rural areas where living costs can be high. Former pensions minister Sir Steve Webb has highlighted that up to 1.6 million older individuals living in poverty might be at risk of losing their winter fuel payments, exacerbating their financial struggles.

In response to the criticism, the government has pointed to the generosity of the triple lock as a counterbalance, emphasizing that it will offer a significant increase in pension income despite the cuts to winter fuel support. Nevertheless, the issue remains contentious, with ongoing debates about the adequacy of support for vulnerable pensioners.