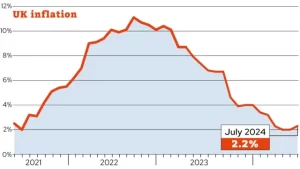

UK Inflation Rate Increases for the First Time This Year

3 min read

The UK’s inflation rate has risen for the first time in 2024, reaching 2.2% for the year ending in July. This increase marks a departure from the 2% rate that had been stable since May, driven by the slower decline in gas and electricity prices compared to the previous year. Despite the uptick, this inflation rate remains lower than the peaks seen in 2022 and 2023, when high energy and food costs severely impacted households.

The Bank of England had anticipated this rise and expects inflation to climb to 2.75% in the coming months before potentially falling below 2% next year. The next set of economic data, including inflation, employment, and wages, will be released before the Bank’s next rate-setting meeting scheduled for September 19.

In response to soaring inflation, the Bank of England had previously raised interest rates but recently lowered them from 5.25% to 5%—the first rate cut since the pandemic began. Higher interest rates generally benefit savers but can increase the cost of mortgages and loans for consumers. With further rate cuts anticipated, experts suggest that a September reduction is plausible, with some predicting multiple cuts within the year.

Sanjay Raja, Chief UK Economist at Deutsche Bank Research, indicated that a September rate cut is a strong possibility, reflecting a shift in expectations. In contrast, Debapratim De from Deloitte noted that while recent inflation figures might not drastically change the Bank’s approach, rate cuts could still be on the horizon. The Bank also evaluates inflation within the services sector when setting rates. Although inflation in this sector slowed to 5.2% in July, this was influenced by volatile elements like airfares and hotel costs.

For businesses grappling with high costs and inflation, potential interest rate cuts could provide relief. Livia Marrocco, who owns a restaurant and ice cream shop in Hove, reported that while ingredient costs have risen, increased customer traffic due to favorable weather and school holidays has been beneficial.

For businesses grappling with high costs and inflation, potential interest rate cuts could provide relief. Livia Marrocco, who owns a restaurant and ice cream shop in Hove, reported that while ingredient costs have risen, increased customer traffic due to favorable weather and school holidays has been beneficial.

Inflation had surged to 11.1% following the Ukraine war and pandemic-induced supply chain disruptions, significantly raising living costs. However, it had been declining until June, as the Bank’s interest rate hikes aimed to temper consumer demand. Grant Fitzner, Chief Economist at the Office for National Statistics (ONS), noted that the July inflation increase was minor. Domestic energy costs fell but at a slower rate than the previous year, while hotel costs decreased after a period of growth.

Despite this rise, Fitzner assured that underlying inflation pressures remain moderate, with service price inflation easing and food prices remaining stable. The Institute for Fiscal Studies highlighted that between September 2021 and September 2023, food and drink prices soared by 28.4%. Lower-income households were disproportionately affected, facing higher price increases on cheaper food brands. By July, however, food price inflation had cooled to 1.5%.

Darren Jones, Chief Secretary to the Treasury, acknowledged the ongoing challenges for households, while shadow chancellor Jeremy Hunt stressed the need for continued efforts to control inflation. The new Labour government faces the task of navigating these economic pressures and implementing strategies to stabilize prices further.

In summary, the UK’s inflation rate has seen its first increase of the year, driven by slower reductions in energy prices and other economic factors. Although inflation remains lower than the highs of recent years, further fluctuations are expected. The Bank of England’s recent rate cut and potential future adjustments reflect ongoing efforts to manage economic pressures and support households and businesses.